In January, White House press secretary Sean Spicer said the Trump administration was considering implementing a 20% import tax on Mexican goods, supposedly to make Mexico pay for Trump’s proposed wall between the U.S. and Mexico. Although Spicer later downplayed his statement, his mention of the import tax was a reminder of the tax reform plan that many Republicans are interested in passing, called a border adjustment tax (BAT). A BAT could impact a slew of skateboard manufacturers, distributors, brands and shops, raise prices for consumers, and rile up an entire industry.

It’s good to know how a skateboard gets made to understand how an import tax could change how much you’ll have to pay for one. Just about every skateboard in the world begins in the Great Lakes region of North America as a sugar maple tree. From there, sugar maple logs, also known as ‘hard rock maple,’ are transported to skateboard factories around the world to be peeled and cut into plies. Factories then glue the plies together, shape them into decks, and heat transfer the relevant graphics on the bottoms for whichever skateboard brands they supply. Given their close access to sugar maples, American skateboard manufacturers traditionally operated their factories in the U.S. But in the ’80s and ’90s, as international transportation became cheaper, remote business operations became more reliable, and everyone’s economy became more global, American skateboard manufacturing companies began moving their factories to Mexico and China to take advantage of those countries’ lower labor costs.

Paul Schmitt, owner of PS Stix, and Grant Burns, owner of Bareback Manufacturing, are two Americans operating skateboard factories in Mexico. They affirmed to me that lower wages are the main reason U.S.-owned board manufacturers choose to operate their factories abroad. Burns estimated that U.S.-owned manufacturers with factories in the U.S. pay their laborers between $15-20 per hour, while laborers in Mexican factories, like PS Stix and Bareback, are paid closer to $4-5 USD per hour. Those in Chinese factories are paid even less.

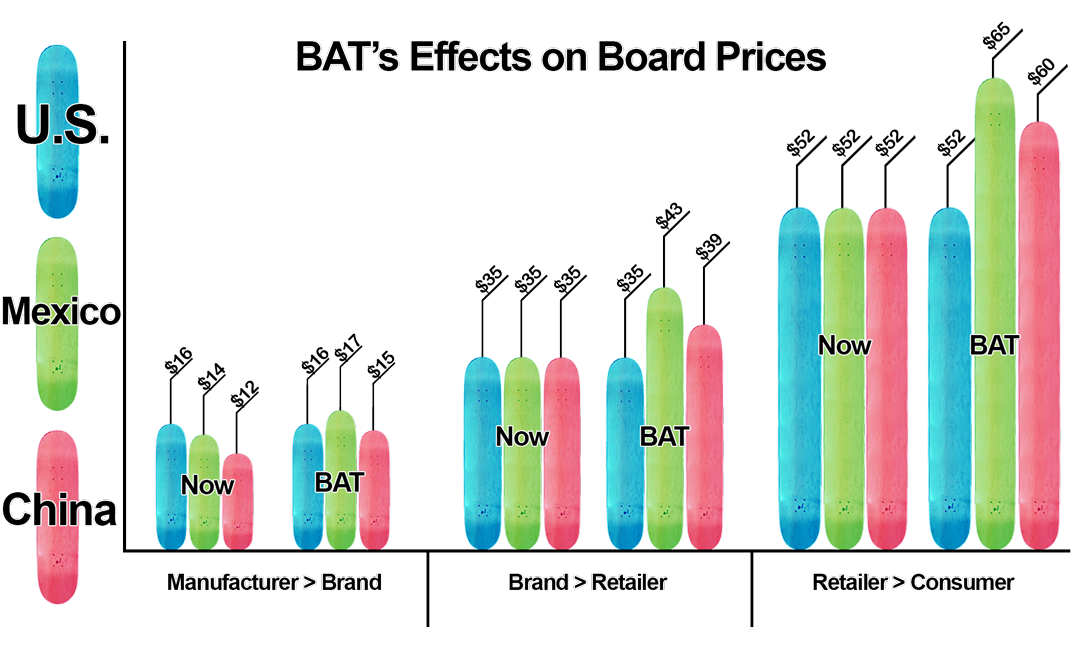

The biggest advantage that lower foreign labor rates provide is increased competitiveness. Because manufacturers spend less to make their boards in Mexico and China than in the U.S., they can afford to sell them to skateboard brands for less than U.S.-made boards and still maintain a profit. Wholesale board prices vary widely depending on additions like screen printed graphics, customized shapes, or alternative ply materials. But according to sources I spoke with for this article, including Jamie Thomas, who used to run the Cinco Maderas skateboard factory in Mexico, the average minimum sales prices for each typical seven-ply, popsicle-shaped skateboard are $16 for U.S. factories, $14 for Mexican factories, and $12 for Chinese factories. Those prices may not differ widely, but for board brands ordering thousands of decks a year, the $2-4 savings per board add up and can be a deciding factor in whether a brand wants to have its boards made in the U.S. or abroad.

This is where the border adjustment tax (BAT) comes in. Under current provisions of the North American Free Trade Agreement (NAFTA), skateboards made in Mexico are not charged any import tax to be brought into the U.S. Chinese boards, which are not covered by NAFTA, are charged a 4% import tax. A BAT would lower the corporate income tax on American companies in general from the current standard of 35% to 20%, then apply that same 20% corporate income tax rate to any products being imported into the country. Thus, a BAT would raise the import tax on Chinese boards, place a new import tax on Mexican boards, but add no tax to American boards, effectively reducing the cost gap between domestic and foreign board manufacturing.

To understand the full effect of a BAT, it’s important to follow a deck through the skateboard industry’s current supply chain. Under a BAT, board brands would have to pay a 20% tax on boards from Mexico and possibly more than 20% on boards from China. So instead of buying boards for $14 and $12 apiece, brands would pay manufacturers close to $17 per board from Mexico and close to $15 per board from China.

Once brands have their boards, they typically have three routes to get them to consumers: through retailers (like your local skate shop or chain store), one-stop distributors (like Eastern Skateboard Supply or AWH) who then sell to retailers, or online directly to consumers. When brands work with either retailers or one-stop distributors they sell most of their boards for between $32-37 each. So if they buy a board for $14 and sell it for a median price of $35, their gross profit is about $21 and their gross profit margin is about 60%. (Since this calculation doesn’t include brands’ costs of paying their employees, renting or owning property, and all the other expenses that go into running a business, the actual net profits and net profit margins are lower. But for simplicity’s sake, we’ll just deal with this 60% gross profit margin.) For brands to retain that profit margin and afford the cost of this newly suggested BAT, they would have to sell the $17 boards they bought from Mexico for $43 each. Meaning that $3 the BAT adds to boards as they leave manufacturers turns into $8 when boards head out to retailers, likely forcing retailers to raise their prices above the $50 standard.

In reporting this article, I heard one idea for keeping board prices down for consumers. Jamie Thomas suggested that brands could sell more boards directly to consumers, as many of them already do online, instead of to shops or one-stop distributors. “Unfortunately, the way to avoid increasing the retail price or cutting marketing budgets is to sell more boards direct to consumers so the blended average margin stays the same,” Thomas told me over text message. The direct to consumer model allows brands to sell their boards for higher retail prices of $50-55 dollars each, instead of the $32-37 range they generally get by selling to middlemen.

Everyone else I spoke with thinks higher consumer skateboard prices would be inevitable under a BAT. “Everyone would have to raise their prices,” Paul Schmitt said. “Margins are so thin. A deck started retailing for $50 in 1980. It’s the same way now, but my cost for hard maple is five times what it was 20 years ago.”

One New York City skateshop owner who asked to remain anonymous (let’s call him George) told me he finds the idea of any BAT “kind of terrifying,” and he estimated that if brands raised prices on the boards they sell to shops by $2-4, that could force shops to raise their prices to $65-70. However, George already sees current retail skateboard prices as being on the cusp of an increase. “I think we’re at a tipping point in terms of retail skateboard prices,” George said. “Even if there were no tax, I don’t think it’s sustainable to sell boards around $50.”

“There’s this kind of anomaly about skateboards in the U.S.,” he said, “where everybody thinks skateboards have to cost around $50, no matter what. It’s gotten kind of crazy because some of the top-selling brands are close to $40.” Small retail businesses in general like to see gross profit margins of at least 25%, but for a skate shop buying a board for $40 and selling it for $50, the shop’s gross margin is only 10%. “In other parts of the world, decks are like $90,” he said. “I don’t know what the solution is and I’m not trying to change it myself, but I don’t think it’ll be possible in five or seven years to sell skateboards for $50-55.”

I asked George if he thinks a BAT could drive enough hardgoods sales away from skate shops that shops would be a risk of closing. He told me it was a possibility, but one he hoped to be able to work through. “It would be unfortunate if there weren’t any other options than cutting the shops out of the equation,” he said. “But I feel like there is this attachment to the notion of this place called the skate shop. I would hope we could still have that aspect in skateboarding because I think it is something people care about.”

Although Trump doesn’t “love” the BAT, many Republicans think it would be a way to achieve progress toward Trump’s goals of decreasing U.S. trade deficits and increasing U.S. manufacturing jobs. And to Republicans’ credit, a BAT would help skateboard manufacturers with U.S. factories. They’d receive the perks of lower corporate income taxes without the import taxes that would cause their competitors in Mexico and China to raise prices. However, a BAT can’t revive U.S. manufacturing to what it was 40 or 50 years ago or solve other complex issues that are part of our modern, global economy. “It’s going to make them more competitive,” Burns said of a BAT’s effect on U.S. skateboard manufacturers. “But is it going to make it so they can produce for the same price that I can in Mexico, or what a Chinese manufacturer can? No.”

George estimates that 70-80% of the boards sold at his shop are made in Mexico or China. While a BAT would force George to raise prices on those decks, he told me he would feel obligated to not raise his prices on U.S.-made decks. If shoppers had the choice of paying about $50 for a U.S.-made board or paying $65-70 for Mexican- and Chinese-made boards, George thinks many would choose the less expensive U.S. boards. Over time, he also thinks board brands that currently use Mexican- or Chinese-made boards would see the decline in retail sales and switch to using U.S.-made boards. I contacted Joe, the owner of Pennswood Manufacturing, which has been making skateboard in the U.S. for 20 years. Joe told me he’s already heard of board brands looking into the possibility of switching over U.S.-made boards. “I have had a number of interesting conversations with brands much larger than we normally deal with about setting up possible avenues for U.S. produced boards,” Joe told me over e-mail.

While an influx in clients seems great for U.S. manufacturers, George wonders if it’s something U.S. board factories could accommodate. “People say it would be great because it would bring all the manufacturing being done by companies in Mexico and China back to the U.S.,” he said. “But the problem is, we don’t have the infrastructure anymore.” Joe at Pennswood thinks U.S. board factories have some room for expanding production — “I don’t think U.S. shops are running three shifts of 24/7 production. That is an easy way to add capacity,” Joe told me over email — but he acknowledges that U.S. factories don’t have any presses lying around unused. Since skateboard factories began leaving the U.S. 30 years ago and taking orders from board brands with them, factories that remained in the U.S. slimmed down in size and production capacity. If too many brands wanted to make the switch to U.S.-made boards, they might not all be able to do so simultaneously.

Using a BAT to raise prices on imported skateboards might help U.S.-made decks in the marketplace and bring jobs to skateboard factories in the U.S., but it would be doing so at the direct expense of skateboarders. By incentivizing manufacturers to further bypass retailers, a BAT would also threaten skate shops, which are often central to local skate scenes. Skate shops are not only places for skaters to connect, but also hosts for contests and video premieres, builders and financiers of DIY spots, and providers of extra bolts, bearings, and used decks for skaters in need.

This Republican version of a BAT is a broad approach. But the interdependent parts making up any industry or economy require nuance and compromise. Americans are so dependent on the low prices of certain Mexican and Chinese imports, such as electronics, clothes, and fruits, that they couldn’t afford to pay a 20% import tax on them or switch to American suppliers. As Grant Burns told me, “If there’s a 20% tax on everything that comes in, that’s at a manufacturing level. That would equate to an 80% increase at the retail price in some items. Consumers would revolt.” Fortunately for skateboarders, Americans’ international dependencies may prevent the Trump administration from passing a BAT that includes such a high import tax. “I think there’s going to be a border tax in the 5% range,” Burns said. “So a board that goes for $50-55 at a retail shop now might be $52-58.” For my own sake as a cheap skateboarder, I hope Burns is right.

Comments

Popular

-

A CHAT WITH LUDVIG HAKANSSON, THE OLDEST SOUL IN SKATEBOARDING

A CHAT WITH LUDVIG HAKANSSON, THE OLDEST SOUL IN SKATEBOARDING

The man loves to read Nietzche, skates in some expensive vintage gear, and paints in his own neoclassical-meets-abstract-expressionist style.

-

HANGING OUT WITH ANDREW HUBERMAN, SKATEBOARDER TURNED NEUROSCIENTIST

HANGING OUT WITH ANDREW HUBERMAN, SKATEBOARDER TURNED NEUROSCIENTIST

Curious what it would be like to hang with this guy outside of a stuffy podcast studio? Us too.

-

GROWING UP, MOVING OUT, AND BREAKING BOARDS

GROWING UP, MOVING OUT, AND BREAKING BOARDS

A personal essay recounting a love affair with something we're all too familiar with.

-

INTRODUCING THE NEW JENKEM COLLECTION, JUST IN TIME FOR THE HOLIDAYS

INTRODUCING THE NEW JENKEM COLLECTION, JUST IN TIME FOR THE HOLIDAYS

Air fresheners, bumper stickers, a shirt with a gun on it and a bunch of other stuff.

-

HOW CHAD CARUSO SKATED ACROSS AMERICA

HOW CHAD CARUSO SKATED ACROSS AMERICA

Chad did it the way most skateboarders would: independently and without much of a plan.

March 27, 2017 4:20 pm

I owned a skate shop via boston in the late 90’s (hanger 18) and know well the markup on decks is not enough to sustain paying rent. I was lucky eneough to have low rent and a sk8 clothing line that helped me make up the difference, because the boards on the wall are what brings people in the door, but if (knock on wood) this increase happens,, it is gonna be a big buzzkil to the industry, #dumptrump

March 27, 2017 4:42 pm

This is the least of the problems with Trump. And you’re writing a shallow economics article geared towards skateboarders. You’d probably have better success using a real world example of something that matters, like weed!

March 27, 2017 5:38 pm

^

damn stoners

thx for the spam legalize

March 27, 2017 7:04 pm

Jamie Thomas’ idea would be to sell directly to consumers therefore deeming skateshops useless… Thanks Jamie, shops that have supported you for years are stoked on that idea.